Charity legacy income is estimated to have reached £4bn and bequest numbers almost 140,000 in the year 2022/23 — an annual income growth of 6.5%. The record growth is estimated based on this year’s Legacy Monitor, our annual benchmarking research programme, which gathers data from over 80 charities, accounting for almost 50% of the charity legacy market.

Legacy Market Review 2023

To get a free copy of our latest Market Review download here

Key points from our findings

Immediate future looks less optimistic

These results once again illustrate the resilience of the legacy market. Although, while the upward growth trajectory looks set to continue for the long-term, Legacy Foresight warns that current economic conditions are likely to negatively impact growth in the coming months.

Recent growth in legacy incomes has been helped by a buoyant housing market that supports the value of legacy gifts. However, this is likely to be a short-lived boost, as the housing market has already started to fall, and we expect to see this negatively impact average legacy values over the next year.

Jon Franklin, Economist at Legacy Foresight

Falling house prices not only impacts average gift values but can also affect the time taken between notification (when a charity is informed that a death has resulted in a charitable gift) and money being received by charities. This is due to people delaying house sales and holding out for prices to rise. While this doesn’t change income over the long run, it does create a short-term challenge for charities in terms of cash flow and budgeting.

Probate administration issues delay £900m reaching charities

Despite high numbers of deaths in the year to March 2023 (681,000 compared to 633,000 in 2021/22), the expected increase in bequest numbers did not follow. This was largely due to the number of cases ‘stuck’ in probate processing at His Majesty’s Courts and Tribunal Service (HMTCS). Legacy Foresight’s research indicates an estimated 70,000 cases, equating to £900m in legacy income is caught up in the backlog and has not yet been passed through to charities.

With deaths predicted to reach 700,000 per year by 2030 and 800,000 by 2050 (due to the ageing baby boomer population), a further challenge will be presented to the probate administration service.

Medium-term forecast — relatively subdued, with a fall of 5%

The projected fall in house prices means that the medium-term forecast for legacy income is relatively subdued. Over the next four years, legacy income is expected to drop slightly, to just under £3.8bn in 2025/26 — a fall of 5%.

While a fall in legacy income isn’t good news, it’s worth noting that this reduction is fairly small and comes at a time when other forms of fundraised income are under even more pressure due to donors feeling the squeeze of the cost-of-living crisis. Given this, legacy income will remain a resilient source of income during the challenging next few years.

Kathryn Horsley, Director of Insight at Legacy Foresight

Long-term forecast: accelerated growth — over £6bn predicted income by 2050

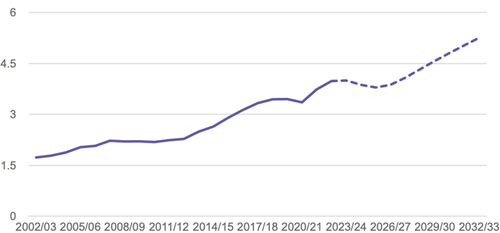

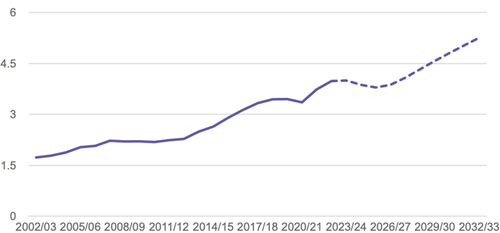

The analysis shows that, looking beyond 2026, the forecast for the legacy market is a lot more positive, with an expected return to accelerated growth. In real terms, legacy income is predicted to reach over £6bn by 2050. This is due to an expected rise in deaths, along with a return to house price growth from 2025/26.

Fig 1: Long-term predicted growth of UK legacy income, £bn

While growth in legacy income is positive news, charities need to be aware that the market is becoming more crowded. With more charities vying to be heard in the legacy market, it is getting harder to maintain and grow share. Smaller charities with smaller budgets are finding it easier to spread their legacy programmes to potential legators as digital marketing for legacies becomes more mainstream.

Charities must therefore be prepared to plan, invest and be creative to secure their space in this evolving sector.

Particularly in such tough economic times, charitable legacies have never been more valued. Fundraisers, finance teams, CEOs and trustees at any charities with established legacy fundraising programmes will no doubt be thankful that their predecessors had the foresight to invest in legacies in years gone by, helping them weather the current storm.

Lucinda Frostick, Director, Remember a Charity